Managing the financial aspects of an online business can be a daunting task, especially when it comes to taxes and accounting. With the right approach and tools, however, you can ensure your business stays compliant with tax regulations and maintains accurate financial records. This in-depth guide will walk you through the essential steps for effectively managing taxes and accounting for your online business, providing you with a strong foundation for success. Managing taxes and accounting for your online business can be complex, but with the right approach and tools, you can handle it efficiently.

12 Steps To Manage Taxes And Accounting For My Online Business

-

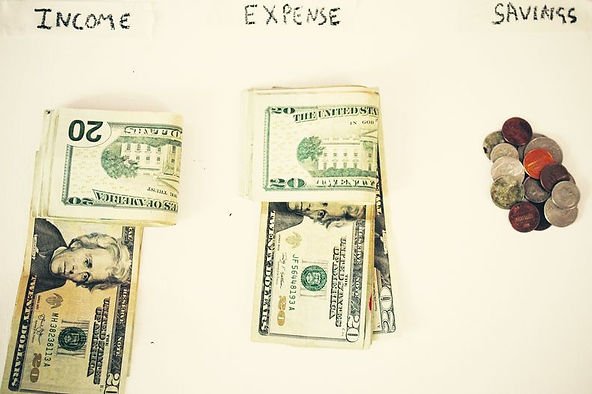

Separate personal and business finances: Open a separate bank account and credit card for your business transactions. This makes it easier to track income and expenses, as well as maintain accurate financial records.

-

Choose an accounting method: Decide between cash-basis or accrual accounting. Cash-basis accounting records transactions when cash is received or paid, while accrual accounting records transactions when they’re incurred, regardless of when cash changes hands. Most small businesses use cash-basis accounting because it’s simpler.

-

Set up a bookkeeping system: Bookkeeping is the process of recording your business’s financial transactions. You can choose from manual bookkeeping, spreadsheets, or accounting software. Accounting software is the most efficient option, as it automates many tasks and ensures accuracy.

-

Track income and expenses: Categorize and record all business income and expenses, and keep supporting documents such as invoices and receipts. Be sure to track deductible expenses, as these can reduce your taxable income.

-

Understand sales tax: As an online business, you may be required to collect and remit sales tax depending on your location and the location of your customers. Research the sales tax requirements in your area and for the regions where you have customers. Use a tax management tool or work with a tax professional to ensure compliance.

-

Pay estimated taxes: Depending on your location and business structure, you may need to pay estimated taxes quarterly. Consult with a tax professional to determine your obligations and avoid underpayment penalties.

-

Prepare financial statements: Regularly prepare financial statements, such as the income statement, balance sheet, and cash flow statement. These documents provide insights into your business’s financial health and help you make informed decisions.

-

Utilize accounting software: Invest in accounting software that is tailored to your specific business needs. This will automate many tasks, help you stay organized, and ensure accurate financial reporting.

-

Regularly review and reconcile your accounts: Review your financial transactions and reconcile your bank and credit card statements regularly to catch errors and identify discrepancies.

-

Consult with professionals: Hire a certified public accountant (CPA) or tax professional to help you navigate tax laws, plan for tax obligations, and prepare your tax returns. This will ensure compliance and help you take advantage of potential deductions and tax-saving strategies.

-

Maintain accurate records: Keep accurate and organized financial records, and store them securely. Retain supporting documents, such as invoices and receipts, for the required duration as per tax laws in your region.

-

Stay informed about tax changes: Tax laws and regulations may change over time. Stay informed about changes that could affect your business and consult with your tax professional to ensure compliance.

By following these steps, you’ll establish a strong foundation for managing taxes and accounting for your online business, helping you maintain compliance, minimize tax liabilities, and make informed financial decisions.

Separate Personal And Business Finances

Separating personal and business finances is a crucial step in managing your online business. When you maintain separate accounts, you simplify your financial management, improve your record-keeping, and protect your underpayment penalties assets. Let’s delve deeper into the benefits and methods for separating your personal and business finances:

Benefits Of Separating Personal And Business Finances

Clear Financial Records

Keeping separate accounts for business transactions helps you clearly distinguish between personal and business expenses. This makes it easier to generate accurate financial reports, monitor your business’s financial health, and identify tax-deductible expenses.

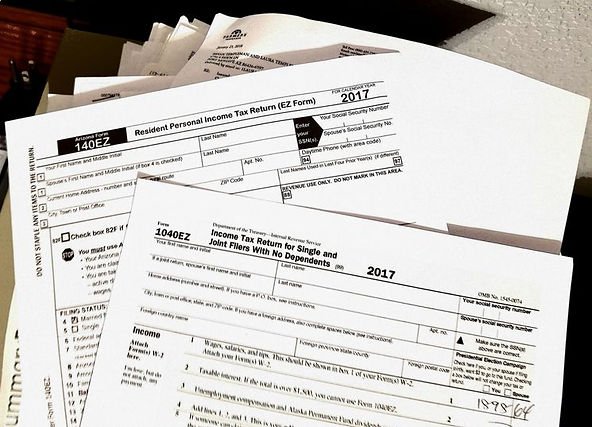

Easier Tax Preparation And Compliance

With separate accounts, it’s simpler to prepare your business’s tax returns, as you can easily identify and categorize income and expenses. This separation also helps ensure compliance with tax regulations and minimizes the risk of errors in your tax filings.

Professionalism And Credibility

Using dedicated business accounts and credit cards demonstrates professionalism to your clients, suppliers, and financial institutions. This can lead to better business relationships and potential.

Simplified Budgeting And Cash Flow Management

Personal Asset Protection

Depending on your business structure, having separate accounts may protect your growth opportunities assets from business liabilities. In the event of financial or legal issues, creditors may have a harder time accessing your funds if your business finances are separate.

Steps To Separate Your Personal And Business Finances

Register Your Business

If you haven’t already, register your business and obtain any necessary licenses or permits. This creates a legal distinction between you and your business, which is essential for separating finances.

Obtain An EIN (Employer Identification Number)

An EIN is a unique identifier for your business, used for tax reporting purposes. In most jurisdictions, you’ll need an EIN to open a business bank account.

Open A Business Bank Account

Choose a bank that offers suitable services for your business and open a checking account exclusively for business transactions. This will help you keep your business income and expenses separate from your finances.

Get A Business Credit Card

Apply for a business credit card to use exclusively for business expenses. This will help you build your business’s credit history, simplify expense tracking, and provide potential rewards or benefits tailored to businesses.

Set A Salary Or Draw

Establish a regular salary or owner’s draw from your business account to your account. This will help you avoid dipping into your business funds for personal expenses, and provide a clearer picture of your business’s financial performance.

By following these steps and maintaining separate personal and business finances, you’ll establish a strong foundation for managing your online business’s financial health, streamline your tax and accounting processes, and safeguard your assets.

Choose An Accounting Method

Choosing the right accounting method for your online business is essential, as it determines how you record and report your business’s financial transactions. There are two main accounting methods: cash-basis and accrual accounting. Each method has its advantages and disadvantages, so it’s important to understand how they work and which one is best suited for your business.

Cash-Basis Accounting

In cash-basis accounting, you record transactions when cash is received or paid. Revenues are recognized when you receive the payment, and expenses are recorded when they are paid. This method is often preferred by small businesses because of its simplicity.

Advantages of Cash-Casis Accounting:

-

-

-

Easy to understand and implement, making it suitable for small businesses with straightforward transactions.

-

Provides a clear picture of cash flow, as you record transactions only when cash is exchanged.

-

Can help with tax planning since you can time your income and expenses to minimize your tax burden in a particular year.

-

-

Disadvantages of Cash-Basis Accounting:

-

-

-

Does not provide an accurate representation of your business’s financial health in the long term, as it doesn’t account for outstanding receivables or payables.

-

May not be allowed for businesses with an annual gross income above a certain threshold, or those with inventory.

-

Not compliant with Generally Accepted Accounting Principles (GAAP), which could be a disadvantage if you plan to seek external financing or investors.

-

-

Accrual Accounting

In accrual accounting, you record transactions when they are incurred, regardless of when cash changes hands. Revenues are recognized when they are earned, and expenses are recorded when they are incurred.

Advantages of Accrual Accounting:

-

-

- Provides a more accurate representation of your business’s financial health, as it accounts for outstanding receivables and payables.

-

Compliant with GAAP, making it suitable for businesses seeking external financing or investors.

-

Allows for better financial planning and budgeting, as you can see the full scope of your business’s financial obligations and expected income.

-

Disadvantages of Accrual Accounting:

-

-

- More complex than cash-basis accounting, which may require additional resources, such as hiring an accountant or investing in accounting software.

-

Can make cash flow management more challenging, as it doesn’t directly show when cash is received or paid.

-

To decide which accounting method is best for your online business, consider the following factors:

Size and Complexity of Your Business

Smaller businesses with simple transactions may prefer cash-basis accounting, while larger businesses or those with more complex transactions may benefit from accrual accounting.

Tax Implications

Cash-basis accounting can offer more flexibility in tax planning, but may not be allowed for businesses above a certain size or with inventory.

Financial Reporting Requirements

If you need to adhere to GAAP or plan to seek external financing, accrual accounting may be more appropriate.

Once you’ve chosen an accounting method, it’s important to remain consistent in your record-keeping and reporting. If you decide to switch methods, consult with a tax professional or accountant to ensure compliance and accurate financial reporting.

Set Up A Bookkeeping System

Setting up a bookkeeping system is a crucial aspect of managing your online business’s finances. An effective system helps you maintain accurate financial records, monitor your business’s performance, and ensure tax compliance. There are three primary options for bookkeeping systems: manual bookkeeping, spreadsheets, and accounting software. Each has its advantages and disadvantages, so it’s important to choose the one that best suits your business’s needs.

Manual Bookkeeping

Advantages:

-

-

-

Low cost, as it doesn’t require specialized software or tools.

-

Can be an appropriate option for businesses with simple financial transactions.

-

-

Disadvantages:

-

-

-

Time-consuming and labor-intensive, as it requires manual entry of transactions.

-

Higher risk of errors and inaccuracies due to human error.

-

Limited reporting and analysis capabilities compared to digital methods.

-

-

Spreadsheets

Advantages:

-

-

-

Relatively low cost, as spreadsheet software, is widely accessible and often included with office productivity suites.

-

Customizable templates to suit your business’s needs.

-

Basic reporting and analysis capabilities.

-

-

Disadvantages:

-

-

-

Can be time-consuming, as data entry is still manual.

-

Risk of errors due to manual entry or formula mistakes.

-

Limited automation and integration with other business systems.

-

Scalability can be an issue as your business grows and transactions become more complex.

-

-

Accounting Software

Advantages:

-

-

-

Automation of many tasks, such as transaction categorization, reconciliation, and report generation, saves time and reduces the risk of errors.

-

Advanced reporting and analysis capabilities provide insights into your business’s financial health.

-

Integration with other business systems streamlines processes and improves efficiency.

-

Scalable to accommodate your business’s growth and changing needs.

-

-

Disadvantages:

-

-

-

Can be more expensive than other options, as it often requires a subscription or one-time purchase.

-

May have a learning curve, especially for complex software with numerous features.

-

-

To choose the right bookkeeping system for your online business, consider factors such as your business’s size, complexity, budget, and growth potential. For most businesses, accounting software is the most efficient and scalable option, but smaller businesses with simple transactions may find manual bookkeeping or spreadsheets sufficient. Regardless of the method you choose, maintaining accurate and up-to-date financial records is essential for managing your business’s finances effectively and ensuring tax compliance.

Track Income And Expenses

Tracking income and expenses is an essential aspect of managing your online business’s finances. It helps you monitor your financial performance, maintain accurate records, and ensure tax compliance. Here’s an in-depth look at how to track income and expenses effectively:

Categorize Transactions

Create categories for various types of income and expenses, such as sales revenue, advertising costs, office supplies, and shipping fees. This will help you analyze your business’s financial performance and identify areas for cost-saving or growth.

Record Transactions

Record all business transactions, including income and expenses, as they occur. Be consistent with your chosen accounting method (cash-basis or accrual accounting) when recording transactions.

Track Deductible Expenses

Deductible expenses are business costs that can be subtracted from your taxable income, reducing your overall tax liability. Examples of deductible expenses include advertising costs, office supplies, travel expenses, and employee salaries. Be sure to track these expenses and maintain supporting documentation to maximize your tax savings.

Keep Supporting Documents

Retain all documents related to your business’s financial transactions, such as invoices, receipts, bank statements, and credit card statements. These documents serve as evidence for your income and expenses and are essential for accurate record-keeping and tax compliance.

Use A System For An Organization

Organize your financial documents and records using a system that suits your needs, such as filing cabinets, digital folders, or cloud-based storage. Regularly review and update your records to ensure accuracy.

Automate Tracking And Categorization

Consider using accounting software or a mobile app to automate the process of tracking income and expenses. These tools often include features such as automatic transaction categorization, receipt scanning, and integration with your bank accounts and credit cards.

Reconcile Accounts Regularly

Regularly compare your recorded transactions with your bank and credit card statements to ensure accuracy and identify discrepancies. This process, known as reconciliation, helps you catch errors and maintain up-to-date financial records.

Monitor Financial Performance

Use your categorized income and expense data to generate financial reports, such as income statements and cash flow statements. Analyze these reports to assess your business’s financial performance, identify trends, and make informed decisions.

Set A Budget

Based on your historical income and expenses, create a budget to guide your financial planning and decision-making. Regularly review and adjust your budget as needed to account for changes in your business’s performance or circumstances.

Consult With A Professional

Consider working with an accountant or financial advisor to ensure accurate record-keeping and tax compliance, as well as to gain insights into your business’s financial performance and growth potential.

By diligently tracking your business’s income and expenses, you can maintain accurate financial records, make informed decisions, and optimize your tax strategy. This ultimately contributes to the overall success and stability of your online business.

Understand Sales Tax

Understanding sales tax is essential for any online business, as you may be required to collect and remit sales tax based on your location and the location of your customers. Sales tax regulations can vary significantly by country, state, or municipality, so it’s important to research the requirements relevant to your business and ensure compliance. Here are some steps to help you manage sales tax for your online business:

Determine Nexus

A nexus is a connection between your business and a taxing jurisdiction that requires you to collect and remit sales tax. Nexus criteria may include having a physical presence, reaching a certain sales threshold, or employing workers in that jurisdiction. Research the nexus rules for your location and for the regions where your customers reside to determine your sales tax obligations.

Register For Sales Tax Permits

If you have a nexus in a particular jurisdiction, you’ll likely need to register for a sales tax permit. This enables you to collect and remit sales tax legally in that jurisdiction. Be sure to register in all relevant jurisdictions and renew your permits as required.

Understand Tax Rates And Exemptions

Sales tax rates can vary by jurisdiction and may be influenced by factors such as the type of product or service you’re selling, the customer’s location, and the shipping method. Research the applicable tax rates and any exemptions or reduced rates that may apply to your products or services.

Collect Sales Tax

Based on your nexus and the applicable tax rates, collect sales tax from your customers at the point of sale. Ensure your online shopping cart or payment system is set up to calculate and collect the correct sales tax amounts.

Track Sales Tax Collected

Maintain accurate records of the sales tax you’ve collected, categorized by jurisdiction. This is essential for filing accurate sales tax returns and ensuring compliance.

File And Remit Sales Tax

File sales tax returns and remit the collected taxes to the relevant jurisdictions according to their filing schedules and deadlines. Be sure to follow the specific requirements for each jurisdiction, as they may differ in terms of filing frequency, payment methods, and documentation.

Use A Tax Management Tool

Consider using a tax management tool or software that integrates with your online store or payment system. These tools can help automate sales tax calculation, collection, and reporting, saving you time and reducing the risk of errors.

Work With A Tax Professional

Consult with a tax professional who is familiar with sales tax regulations and online businesses. They can provide guidance on your sales tax obligations, ensure compliance, and potentially help identify tax-saving opportunities.

Pay Estimated Taxes

Estimated taxes are periodic tax payments made throughout the year based on your expected income and tax liability. Depending on your location, business structure, and income level, you may be required to pay estimated taxes. Paying estimated taxes can help you avoid penalties for underpayment or under-withholding, and it can also help you manage your cash flow more effectively. Here are some steps to help you navigate estimated tax payments:

Determine Your Obligation

Your obligation to pay estimated taxes depends on factors such as your business structure, location, and income level. For example, in the United States, self-employed individuals, partners, and S corporation shareholders may need to pay estimated taxes if they expect to owe a certain amount in taxes for the year. Consult with a tax professional or your local tax authority to determine your estimated tax obligations.

Estimate Your Taxable Income

To calculate your estimated tax payments, you’ll need to estimate your taxable income for the year. Consider your business revenue, deductible expenses, and any tax credits you may be eligible for. Keep in mind that your actual income and tax liability may differ from your initial estimates, so you may need to adjust your calculations throughout the year.

Calculate Your Estimated Tax Liability

Once you have an estimate of your taxable income, use the appropriate tax rates and brackets to calculate your estimated tax liability. Keep in mind that self-employment taxes and other taxes may also apply, depending on your business structure and location.

Make Quarterly Payments

Typically, estimated tax payments are due quarterly. Divide your total estimated tax liability by the number of payment periods (usually four) to determine the amount you should pay each quarter. Be sure to make your payments by the specified deadlines to avoid penalties for underpayment or late payment.

Adjust Your Estimates As Needed

If your business’s financial situation changes during the year, or if you find that your initial estimates were inaccurate, update your estimated taxable income and tax liability accordingly. This will help you avoid overpaying or underpaying your taxes and ensure that you’re prepared for your year-end tax return.

Apply Overpayments Or Underpayments To Future Tax Payments

If you overpay or underpay your estimated taxes during the year, you can usually apply the difference to your future tax payments or request a refund. Consult with a tax professional or your local tax authority to determine the best course of action.

Keep Accurate Records

Maintain accurate records of your estimated tax payments, including payment dates, amounts, and any adjustments you’ve made throughout the year. This information will be helpful when preparing your year-end tax return and verifying that you’ve met your estimated tax obligations.

By understanding your estimated tax obligations and making regular payments throughout the year, you can minimize the risk of penalties and maintain the financial health of your online business. Working with a tax professional can provide valuable guidance and help you navigate the complexities of estimated taxes.

Prepare Financial Statements

Preparing financial statements is a crucial aspect of managing your online business’s finances. Regularly generating reports like the income statement, balance sheet, and cash flow statement allows you to assess your business’s financial health, identify trends, and make informed decisions. Here’s an overview of these key financial statements and how they benefit your business:

Income Statement

Also known as a profit and loss statement, the income statement provides a summary of your business’s revenues, expenses, and net income over a specific period, such as a month, quarter, or year. This statement helps you understand your business’s profitability, identify trends in revenues and expenses, and evaluate the effectiveness of your pricing and cost management strategies.

To Prepare An Income Statement:

-

- List and total all revenues generated during the period.

- List and total all expenses incurred during the period, grouped by category (e.g., advertising, rent, salaries).

- Subtract total expenses from total revenues to calculate your net income or loss.

Balance Sheet

The balance sheet provides a snapshot of your business’s financial position at a specific point in time. It lists your business’s assets (what you own), liabilities (what you owe), and equity (the owner’s investment in the business). The balance sheet helps you assess your business’s liquidity, solvency, and overall financial health.

To Prepare A Balance Sheet:

-

- List and total all assets, grouped by category (e.g., cash, accounts receivable, inventory).

- List and total all liabilities, grouped by category (e.g., accounts payable, loans, taxes payable).

- Calculate your equity by subtracting total liabilities from total assets.

Cash Flow Statement

The cash flow statement shows the movement of cash in and out of your business over a specific period. It’s divided into three sections: operating activities (cash generated or used by day-to-day business operations), investing activities (cash used for investments, such as equipment or property), and financing activities (cash generated or used by borrowing or repaying loans, issuing stock, or paying dividends). The cash flow statement helps you understand your business’s cash position, identify cash flow trends, and plan for future cash needs.

To Prepare A Cash Flow Statement:

-

-

Identify and total all cash inflows and outflows for each of the three categories (operating, investing, and financing activities).

-

Calculate the net cash flow for each category by subtracting outflows from inflows.

-

Sum the net cash flows for all three categories to determine the overall change in cash during the period.

-

By regularly preparing these financial statements, you gain valuable insights into your online business’s financial performance and stability. These reports can help you identify areas for improvement or growth, monitor the effectiveness of your financial strategies, and make informed decisions to support your business’s success. Using accounting software or working with a financial professional can simplify the process of preparing financial statements and ensure accuracy.

Utilize Accounting Software

Utilizing accounting software can greatly benefit your online business by automating tasks, ensuring organization, and providing accurate financial reporting. Choosing the right software tailored to your specific business needs is essential. Here are some tips and benefits of using accounting software for your online business:

Streamline Data Entry

Accounting software simplifies data entry by automatically importing transactions from your bank accounts and credit cards. This reduces the risk of manual data entry errors and saves time.

Automate Tasks

Many accounting software solutions offer automation features for tasks such as invoicing, payment processing, and expense tracking. This allows you to focus more on your core business activities and spend less time on manual bookkeeping tasks.

Improve Organization

Accounting software helps you stay organized by providing a centralized platform for managing your financial records. You can easily access and manage your income, expenses, invoices, bills, and other financial data in one place.

Accurate Financial Reporting

Accounting software enables you to generate accurate financial statements and reports, such as income statements, balance sheets, and cash flow statements. This helps you make informed decisions and assess your business’s financial health.

Enhance Tax Compliance

Accounting software often includes features to assist with tax compliance, such as automatic sales tax calculation, estimated tax payment reminders, and integration with tax preparation software.

Monitor Financial Performance

With accounting software, you can easily track your financial performance and identify trends or issues. Most software solutions offer customizable dashboards and reporting features that provide insights into your business’s financial health.

Scalability

Choose accounting software that can grow your business. As your business expands, you may need additional features or integrations to manage more complex financial operations.

Integration With Other Tools

Select accounting software that integrates with other tools and platforms you use, such as your e-commerce platform, payment processor, or inventory management system. This ensures seamless data sharing and streamlined workflows.

Security

Ensure that the accounting software you choose has robust security measures in place to protect your sensitive financial data. Look for features such as encryption, secure data storage, and multi-factor authentication.

Support And Training

Choose a software provider that offers comprehensive support and training resources to help you maximize the benefits of the software and resolve any issues that may arise.

By investing in accounting software tailored to your online business’s needs, you can improve the efficiency and accuracy of your financial management processes. This ultimately contributes to the success and stability of your business.

Regularly Review And Reconcile Your Accounts

Regularly reviewing and reconciling your accounts is an essential aspect of managing your online business’s finances. This process ensures the accuracy of your financial records, helps identify potential errors or discrepancies, and provides a clear picture of your business’s financial health. Here are some steps and benefits of regularly reviewing and reconciling your accounts:

Schedule Regular Reviews

Set aside time to review your financial transactions and reconcile your accounts at least once a month. Consistent and timely reviews help you stay on top of your finances, catch errors early, and make informed decisions based on accurate financial data.

Check Transactions For Accuracy

Review each transaction in your accounting records and ensure that the amounts, dates, and categories are correct. Verify that the transactions have been properly recorded and allocated to the appropriate accounts.

Compare Accounting Records To Bank And Credit Card Statements

Reconciliation involves comparing your accounting records to your bank and credit card statements to ensure that they match. Identify any discrepancies, such as missing or duplicate transactions, and investigate the cause.

Resolve Discrepancies

When you find discrepancies, resolve them promptly by making the necessary adjustments to your accounting records. This may involve adding missing transactions, correcting errors, or re-categorizing expenses.

Monitor Cash Flow

Regularly reviewing and reconciling your accounts allows you to closely monitor your cash flow, ensuring that you have a clear understanding of your business’s financial position. This information can help you make informed decisions about budgeting, investing, and managing debt.

Prevent Fraud

By reviewing your accounts regularly, you can detect suspicious transactions or unauthorized activity early, potentially preventing financial loss or fraud. Promptly address any unusual activity and take appropriate measures to protect your business’s finances.

Maintain Tax Compliance

Accurate financial records are essential for tax compliance. Regular account reviews and reconciliations help ensure that your income, expenses, and deductions are accurately recorded and reported on your tax returns.

Use Accounting Software

Accounting software can simplify the process of reviewing and reconciling your accounts by automating data entry and providing tools for reconciliation. Choose software that integrates with your bank and credit card accounts, allowing for seamless data sharing and streamlined account management.

By regularly reviewing and reconciling your accounts, you can maintain accurate financial records, catch errors or discrepancies early, and ensure the financial health and stability of your online business. This practice ultimately contributes to the success of your business and helps you make informed decisions based on reliable financial data.

Consult With Professionals

Consulting with professionals, such as a certified public accountant (CPA) or tax professional, can provide valuable guidance and support for your online business’s financial management. These experts can help you navigate complex tax laws, plan for tax obligations, and prepare your tax returns, ensuring compliance and maximizing your potential deductions and tax-saving strategies. Here are some benefits and tips for working with financial professionals:

Expertise In Tax Laws

Tax laws can be complicated and are subject to change. A CPA or tax professional can help you understand and comply with the applicable tax laws and regulations for your business, reducing the risk of errors and potential penalties.

Tax Planning And Strategy

Financial professionals can assist you in planning for your tax obligations throughout the year, ensuring that you’re prepared for quarterly estimated tax payments and year-end tax returns. They can also recommend tax-saving strategies and deductions that are relevant to your specific business and industry.

Accurate Tax Preparation

A CPA or tax professional can help you prepare and file your tax returns, ensuring accuracy and compliance with tax laws. Their expertise can help you avoid costly mistakes and maximize your potential deductions.

Representation Before Tax Authorities

In the event of a tax audit or dispute, a CPA or tax professional can represent your interests before tax authorities, providing valuable support and guidance.

Financial Advice And Business Planning

In addition to tax services, financial professionals can offer advice on various aspects of your business’s financial management, such as budgeting, cash flow management, and financial forecasting. Their insights can help you make informed decisions and plan for your business’s growth and success.

Time And Stress Savings

Working with a CPA or tax professional can save you time and stress by handling complex financial tasks on your behalf. This allows you to focus on your core business activities and dedicate more time to growing your online business.

Choose The Right Professional

When hiring a financial professional, look for someone with relevant experience and expertise in your industry or business type. Check their qualifications, credentials, and references to ensure that they’re a good fit for your needs.

Maintain Clear Communication

Establish open lines of communication with your financial professional, providing them with the necessary information and documentation to assist you effectively. Keep them informed of any significant changes in your business that may impact your financial or tax obligations.

By consulting with a CPA or tax professional, you can ensure that your online business remains compliant with tax laws, takes advantage of potential deductions and tax-saving strategies, and benefits from expert financial advice. This support can contribute to the long-term success and stability of your business.

Maintain Accurate Records

Maintaining accurate and organized financial records is crucial for managing your online business’s finances and ensuring compliance with tax laws. By keeping your records in order and retaining supporting documents, you can simplify your financial management processes, prepare accurate tax returns, and minimize the risk of errors or penalties. Here are some tips for maintaining accurate financial records:

Separate Personal And Business Transactions

Use separate bank accounts and credit cards for your personal and business transactions. This makes it easier to track income and expenses and maintain accurate financial records.

Categorize Income And Expenses

Record all business income and expenses and categorize them appropriately (e.g., advertising, rent, supplies). Proper categorization helps you understand your business’s financial performance and identify areas for improvement.

Retain Supporting Documents

Keep copies of all supporting documents, such as invoices, receipts, and bank statements, for the required duration as per tax laws in your region. These documents serve as evidence for your income and expenses and may be required in case of a tax audit or dispute.

Store Records Securely

Store your financial records and supporting documents securely, either in a physical or digital format. Ensure that sensitive financial information is protected with encryption, password protection, and regular backups.

Use Accounting Software

Accounting software can help you maintain accurate and organized financial records by automating data entry, categorization, and reporting. Choose software that meets your business’s needs and integrates with your other financial tools, such as your bank and credit card accounts.

Regularly Review And Reconcile Accounts

Review your financial transactions and reconcile your bank and credit card statements regularly to catch errors and identify discrepancies. This helps ensure the accuracy of your financial records and provides a clear picture of your business’s financial health.

Comply With Record Retention Requirements

Each jurisdiction has its requirements for how long business records must be retained. Familiarize yourself with the record retention requirements in your region and ensure that your records are kept for the required duration.

Consult With Professionals

Consider hiring a certified public accountant (CPA) or bookkeeper to assist with maintaining accurate financial records and ensuring compliance with tax laws. Their expertise can help you avoid costly mistakes and ensure the accuracy of your records.

By maintaining accurate and organized financial records, you can simplify your financial management processes, ensure tax compliance, and make informed decisions based on reliable financial data. This ultimately contributes to the success and stability of your online business.

Stay Informed About Tax Changes

Staying informed about tax changes is essential for managing your online business’s finances and ensuring compliance with tax laws and regulations. Tax laws can change due to new legislation, court decisions, or updates to existing regulations. By staying up-to-date with these changes and consulting with your tax professional, you can avoid potential penalties and take advantage of new deductions or tax-saving opportunities. Here are some tips for staying informed about tax changes:

Subscribe To Tax Newsletters And Alerts

Many tax authorities, accounting firms, and tax organizations offer newsletters and email alerts to keep subscribers informed about tax law changes. Subscribe to these resources to receive regular updates on new developments that could affect your business.

Follow Tax-Related Blogs And Websites

Numerous tax-related blogs and websites provide valuable insights and analysis of tax law changes. These resources can help you understand the implications of new regulations and how they may impact your business.

Participate In Webinars And Workshops

Many organizations offer webinars and workshops on tax law updates and changes. Attending these events can provide a deeper understanding of new tax regulations and allow you to ask questions and clarify any uncertainties.

Join Industry Associations And Networking Groups

Participating in industry associations and networking groups can help you stay informed about tax changes that are relevant to your specific industry. These organizations often provide resources, updates, and guidance on tax issues that affect their members.

Use Social Media

Follow tax professionals, organizations, and government agencies on social media platforms to stay updated on tax law changes and other relevant news.

Consult With Your Tax Professional

Maintain regular communication with your CPA or tax professional, who can guide tax law changes and their impact on your business. They can help you adjust your tax strategy and ensure compliance with new regulations.

Monitor Legislative Updates

Keep an eye on legislative updates in your jurisdiction, as new laws and regulations may affect your tax obligations. Familiarize yourself with any changes and consult with your tax professional to understand how they may impact your business.

By staying informed about tax changes and working closely with your tax professional, you can ensure that your online business remains compliant with tax laws and benefits from any new deductions or tax-saving opportunities. This proactive approach to tax management contributes to the long-term success and stability of your business.

In conclusion, by implementing the steps outlined in this guide, you’ll establish a solid foundation for managing taxes and accounting for your online business. By separating your finances, choosing the right accounting method, tracking income and expenses, staying informed about tax changes, and consulting with professionals, you can maintain compliance, minimize tax liabilities, and make informed financial decisions. The effort you put into managing your business’s finances will pay off in the long run, contributing to the overall success and stability of your online venture. You can join our coaching program for more tips and strategies in e-commerce.